Roller Coaster Pricing

Roller Coaster Pricing

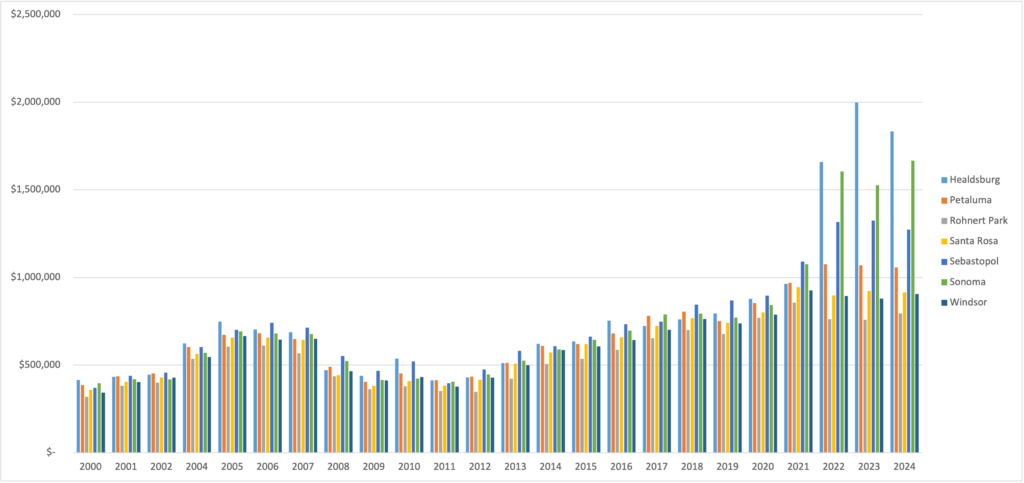

Rising home prices are a popular topic for established homeowners. Not so much for renters and others trying to enter a challenging market. This century witnessed prices plummet in 2008 after the financial crisis. Since the market bottom in 2011 prices have shown a steady rise year over year. Covid helped shape a new market. Working from home ballooned into the primary way many office workers did their jobs. Attractive locations with low home prices relative to San Francisco and the Peninsula took off in value. Recent years have seen record increases in prices.

Interest Rates Magnify the Pain of Higher PricesRising interest rates on top of the recent price increases challenge first time homebuyers trying to enter the real estate market. A useful tool from the California Association of Realtors called the affordability index shows that only 35% of Sonoma County households could afford to buy the median priced home in the 3rd quarter of 2024. For a median priced home at just over $709,000, the monthly payment including taxes and insurance is $4,700 and requires an income of $140,000. That pricing denies the vast majority of service workers a chance to build housing equity.

Prices and interest rates are going to be the story of real estate for the foreseeable future. The steady increase of home prices over the last decade may have slowed for now. Sellers are going to have to accept that they will not get the record breaking prices their neighbors may have gotten in 2021. First time home buyers will have to accept that their choice of homes will have a lower price ceiling than in the era of 3% loans.