If your cousin, brother, or best friend’s dog was warning about the housing bubble in 2006, I would pay a lot of attention to them today. Unfortunately, almost everyone else missed the bubble in spite of all sorts of warning signs that we were in an unsustainable market. It’s human nature to go with the crowd, but as we saw with the housing bubble, it can be dangerous not to pay attention to fundamentals such as affordability and historic trends.

That comfort in being part of a pack was a significant contributor to the bubble. Today, herd thinking is contributing to to a large number of ready and willing buyers sitting on the sidelines waiting for better prices, better interest rates, or better selection. It’s smart to want to avoid a mistake when you buy a house. It’s a big investment and we all know people who have lost their savings and their credit because of the housing bubble. At the same time, it’s important to realize that every bubble comes to earth eventually and markets do stabilize and recover. Smart buyers who want to make sure they don’t get caught flat-footed when the housing market in Sonoma County recovers need to pay attention to current trends to make sure they don’t wait too long.

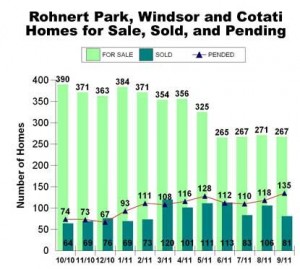

This Rohnert Park/Cotati, Windsor, and Cloverdale sales chart for the last year has valuable information to help buyers decide if now is a good time to buy. Three key indicators I look at include number of units available, sales volume, and whether the pending trend shows increasing or decreasing sales (pending is a real estate term for a contract with all the contingencies satisfied and ready to mark “sold” when the close of escrow date arrives). What we see in this chart are strong indicators of a recovering housing market in these three Sonoma County cities.

- The “homes for sale” inventory has declined from 390 to 267 over the last year.

- The sales trend is definitely up. September is down from the highest months in the spring, but is substantially up from a year ago.

- The pending trend (the red ine with triangles) should be ringing alarm bells for you if you are a buyer sitting on the fence. Pending sales will go into the “sold” column in the near future, so it’s easy to see a significant increase in future sales is already embedded in this trend. Look at it again. This line is sales that are essentially already done, but the paperwork hasn’t become official yet.

Sonoma residential housing trends clearly show more homes going into contract. This sales activity has reduced the available inventory by a third from a year ago. What it means in stark terms for home buyers is that you have fewer homes to choose from. Whether current buyers are investors or owner-occupants, there are clearly more people every month who are getting off the fence and making offers to purchase Sonoma residential property.

One technical term for how quickly homes sell is the absorption rate. What we are seeing today is a three to four month absorption rate compared to an absorption rate of six months from a year ago.

The danger isn’t that there will be no houses available. There are always houses for sale. The danger is in jumping into a market that already has many other buyers looking for the same bargain properties. Almost any agent can tell you horror stories of multiple offer situations when the listing price is just a number that’s the starting point for a winning bidder. Your question to sellers today of “how low an offer will you accept?” becomes, “how much do I have to bid over the listing price?”. Trust me, you don’t want to be asking over-bid questions. It’s complicated enough to buy a house without worrying whether you will even get the chance to make the purchase. If you are a qualified buyer, you want to house shop during a buyer’s market where your options are greater and your flexibility is at a maximum.

Prices are still likely to move, either up or down. Buying today isn’t a guarantee that the property you purchase won’t decline in value. However, given the historically low interest rates available to creditworthy borrowers, a few thousand dollars higher or lower in purchase price will be insignificant over a five, seven, or thirty year stay in the house. The risk of inaction is in facing more competition, fewer choices, and a more frenetic buying experience. I didn’t predict the bubble, so I don’t get a gold star as a prognosticator. However, I pay a lot of attention to Sonoma County market trends and think this is an excellent time to get off the sidelines and start writing offers on property that fits your needs.