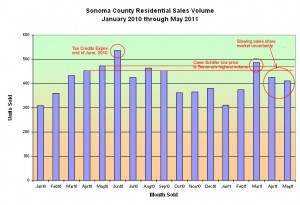

The S&P /Case-Shiller Home Price Indices for the first quarter of 2011 came out a few days ago and showed a decline below the previous low water mark from two years ago in almost all regions of the country. I called that 2009 market bottom in Sonoma County at the time and wanted to know if I was going to have to eat my words.

In parallel with the national sales trends reported this week, but performing at a slightly higher level, Sonoma County’s market bottom that I called in the spring of 2009 has still not been breached. We came close in March, improved slightly in April, and recovered our recent price levels in May. We came close to a new low average sales price in Sonoma County, but for now the worst results in our real estate market are still several years in the past.

Many buyers I talk to are worried that the market will continue to decline. I hate to use the term “uncertainty” since it is abused so much as a political tool at the national level, but I think it’s fair to say that everyone in our industry is uncertain about the future.

There are some strong reasons to buy now. Perhaps strongest is that interest rates are low and financing a home is more affordable than any recent time. The flip side of the great rates is that only people with excellent credit are being approved. Woe to the person with a late fee to a department store three years ago. There is almost no ding to your credit too small for the underwriter to seize upon.

Another reasons I give to my buyer clients for being active now is that the inventory is high and the competition is lower than normal. One of the most frustrating problems, particularly for new and first time buyers is that a seller’s market creates extra competition to be the high bidder. In today’s environment (June 2, 2011…not to be confused with any other environment) a buyer is likely to be able to submit an offer and get a response that isn’t a multi-party counter-offer. Sure, there are aggressively priced homes that get multiple offers, but those are the exceptions.

I stuck my neck out two years ago when I called the market bottom. I’m not quite so confident that today’s prices will stay above that spring 2009 pricing. However, I am confident that we are in the right range for the Sonoma County single family home market. I will still tell my clients that buying is a better option than renting for people that are planning to stay in the home for many years. On the other hand, if you’re a young graduate with a short credit history who is paying off student loans, welcome to the rental market…or mom’s basement.