Just for the sake of argument, let’s call a million bucks a luxury cut-off for Sonoma County homes. Sure there are less expensive homes that are luxurious and there are far more expensive estate properties with dated, badly designed older homes that fail any test of Sonoma County luxury. Still, this assumption is for the sake of argument, so humor me.

I wanted to look at the last five years and see what the trends have been. We all have some instincts about housing bubble pricing, but I wanted something more than “a feeling” to share with my clients. If you are going to be investing seven figures in real estate, it’s nice to know what the numbers can tell you. I chose mid 2005 for my data starting point since it is clearly before the bubble peak was reached. It’s also close enough in time that most of us can remember watching the price escalator and talking to friends and family about real estate valuations (and how much money we made on our house last month).

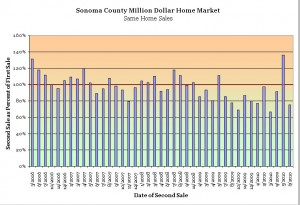

There aren’t many cookie-cutter luxury homes in Santa Rosa, Healdsburg, or Sonoma, so in order to do an apples to apples comparison I pulled out the 86 homes that have sold twice (for more than $1,000,000) since the summer of 2005. That’s from a total list of 1,579 $1,000,000 Sonoma County residential transactions during the last 60 months.

I don’t think the results will shock you. Prices went up in 2006 and early 2007 and have since gone down…

(click on graph for bigger view)

The horizontal red line is the base line for the comparison. Columns above the red line sold the second time for more than their original sale price. Beneath the red line the homes have been discounted. Until May of 2007, most of the columns are above the red line. After that, the price decline started and prices have bumped up and down, mainly down, ever since.

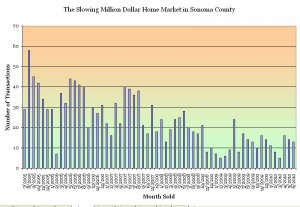

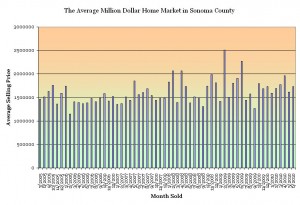

We’ve seen a hint of a recovery in price stability since last spring in the first graph, but the second graph clearly demonstrates the lower volume of sales compared to 2005 through 2007. From a volume point of view, the end of 2008 and early 2009 was the low point for luxury home sales. That coincides with the financial meltdown dominating the news with consumer confidence at a low point. We have recovered to almost twice the volume of that gloomy time, but have not returned to the vigorous volume of the bubble peak years.

The biggest discount I tracked in my research was for a property in Sonoma that sold in July of 2007 and then again in January of this year. The price declined by 34% during that time which closely matches some of the results from median priced homes in the area. Still, that’s the worst decline I tracked and many sales in 2010 are closer to 80-90% of their earlier prices. Some are actually higher, probably reflecting improvements to the property.

If you look at the entire list of $1,000,000 homes that have sold during this time frame, there’s a large amount of consistency. We’re selling fewer luxury homes in Sonoma County, but they are selling for a gradually increasing price month in and month out. These are averages, of course, but they do reflect the valuation of high end homes in Santa Rosa, Sonoma, Healdsburg, and elsewhere in the county.

Choosing the right home to buy is a process that includes design, taste, vintage, location, setting, and a host of other aesthetic and utility factors. I enjoy that part of the hunt. As this post shows, I also like the exercise of looking at market trends with my clients so they can overlay an understanding of the local market on top of their gut reactions to the homes they are looking at. I hope this data gives you some insight into the high end Sonoma market. I’m easy to get in touch with if you are hunting for a Sonoma luxury home and need some analytical help.

The luxury Healdsburg listing featured in the picture at the top of this post is from Mariann Ilaria at our Artisan Sotheby’s International Realty office.